Macrs Life Of Solar Panels

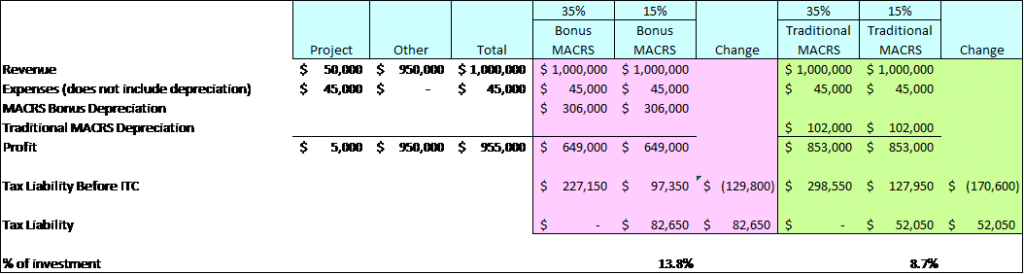

An example of solar depreciation benefits.

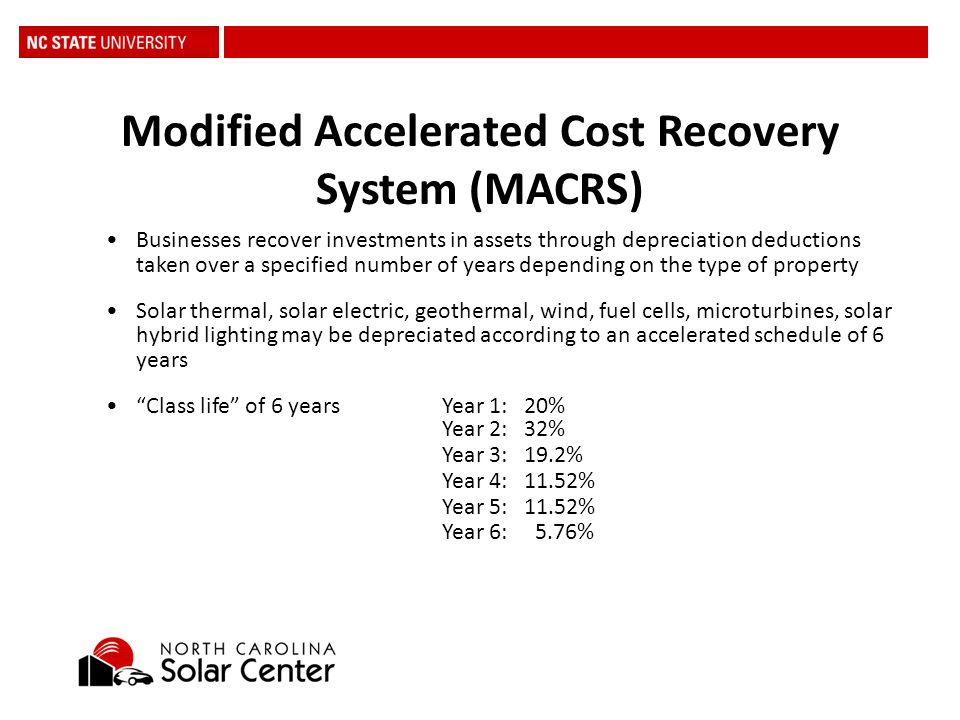

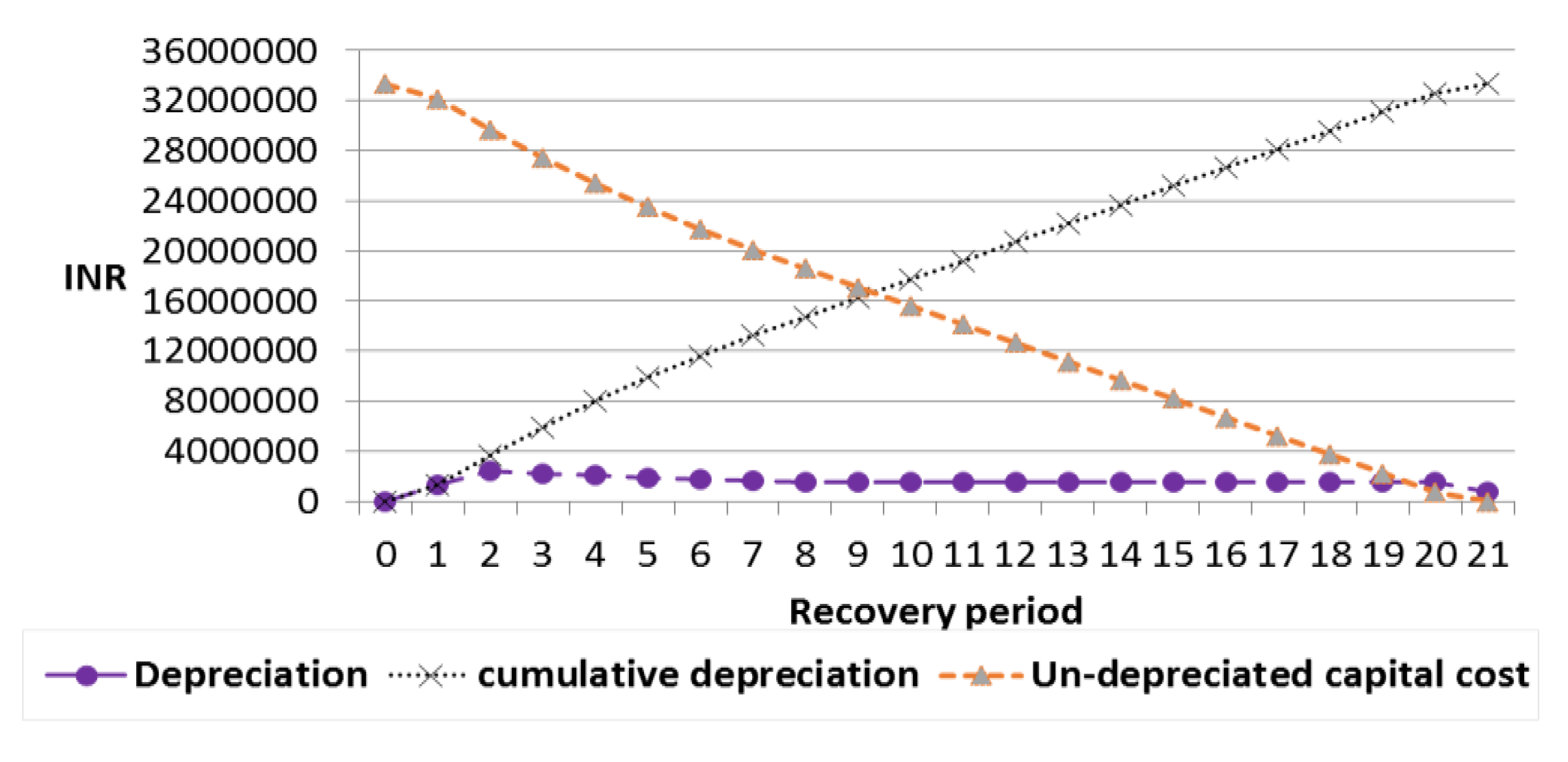

Macrs life of solar panels. The modified accelerated cost recovery system macrs established in 1986 is a method of depreciation in which a business investments in certain tangible property are recovered for tax purposes over a specified time period through annual deductions. As long as you install this system in 2020 you ll be able to take advantage of the federal solar incentive tax credit at 26. This greatly enhances your ability to recover the costs from your solar investment. Macrs depreciation is an economic tool for businesses to recover certain capital costs over the solar energy equipment s lifetime.

Let s figure out the macrs depreciation for a solar system that costs 300 000 before incentives. More importantly i don t know your whole situation but i feel like you are eligible for a form 3468 investment credit for your solar panels. Normally the depreciable life of solar panels is 85 of the full solar system cost which may be depreciated roughly as follows. In this case solar energy systems have been determined by the irs to have a useful life of five years.

It looks like solar panels have a 5 year life. Year 1 20 year 2 32 year 3 19 2 year 4 11 5 year 5 11 5 and year 6 5 8. This means that you will see the full financial benefits from your solar investment even faster. Macrs pronounced makers stands for modified accelerated cost recovery system and depreciation is known as the reduction in the value of an asset over time due to wear and tear or normal use.

Macrs does not apply to property used before 1987 and transferred after 1986 to a corporation or partnership except property the transferor placed in service after july 31 1986 if macrs was elected to the extent its basis is carried over from the property s adjusted basis in the transferor s hands. The modified accelerated cost recovery system macrs established in 1986 is a method of depreciation in which a business investments in certain tangible property are recovered for tax purposes over a specified time period through annual deductions. Macrs solar accelerated depreciation what is the macrs depreciation benefits of solar panels. However this year you can use 100 bonus depreciation if you would like to take the full cost as depreciation expense in 2018.

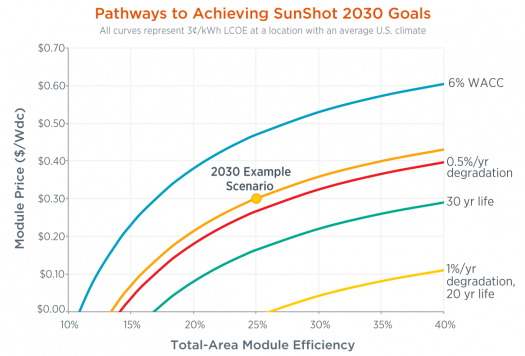

Macrs depreciation of solar panels. Qualifying solar energy equipment is eligible for a cost recovery period of five years. Even though solar arrays will last for decades the irs expects that a business will apportion the entire value of the array over five years in their taxes. Qualifying solar energy equipment is eligible for a cost recovery period of five years.

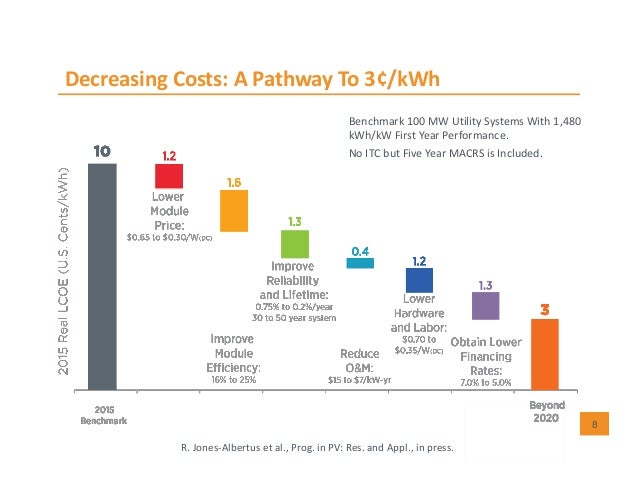

Under macrs all of your qualifying commercial solar assets will fully depreciate within five years. Depreciation is classified as an expense and may be deducted from your taxable income thus reducing the cost incurred for the solar power system. Solar energy systems also qualify for accelerated depreciation.

.jpg)